What is E-Declaration?

E-declaration is a system that allows taxpayers to submit their tax returns electronically to the tax administration via the internet. This system offers significant advantages for both taxpayers and tax administration by transferring the declarations made on paper to the electronic environment. The e-declaration system ensures fast, secure and error-free declaration transactions and reduces the workload of taxpayers.

Purpose and Importance of E-Declaration

Speed and Convenience

The e-declaration system allows tax returns to be submitted quickly and easily. Taxpayers can fill in and submit their declarations electronically from anywhere with internet access. This allows declaration transactions to be carried out regardless of time and place.

Reduced Error Rate

The electronic declaration system prevents errors that are frequently encountered in manually filled paper declarations. The system includes controls to guide users and minimise errors. This ensures that the declarations are filled in correctly and completely.

Cost Savings

The e-declaration system eliminates costs such as paper, postage and archiving. Transactions carried out electronically provide cost advantages for both taxpayers and tax administration. In addition, labour is saved because the processing and archiving of declarations is carried out more quickly and efficiently.

Legal Basis of E-Declaration

The legal basis of the e-declaration system is the Tax Procedure Law and related legislation in Turkey. These legislations regulate the use and implementation of the e-declaration system. Article 5/A of the Tax Procedure Law constitutes the legal framework of the e-declaration application. In addition, general communiqués and guidelines published by the Revenue Administration determine the details and principles of use of the e-declaration system.

Tax Procedure Law and E-Declaration

The relevant articles of the Tax Procedure Law contain provisions regarding the submission of tax returns electronically. This law encourages the electronic filing of tax returns by requiring taxpayers to use the e-declaration system.

Revenue Administration Regulations

The Revenue Administration makes regulations for the implementation of the e-declaration system and announces these regulations through general communiqués and guidelines. These communiqués contain detailed information on how to fill in, submit and approve the e-declaration.

Operation and Process of E-Declaration

Declaration Types

The e-declaration system enables electronic submission of declarations for various types of taxes. E-declaration can be used for many tax types such as income tax, corporate tax, value added tax (VAT), withholding tax. Declaration forms for each tax type are determined by the Revenue Administration and made available through the e-declaration system.

Declaration Preparation

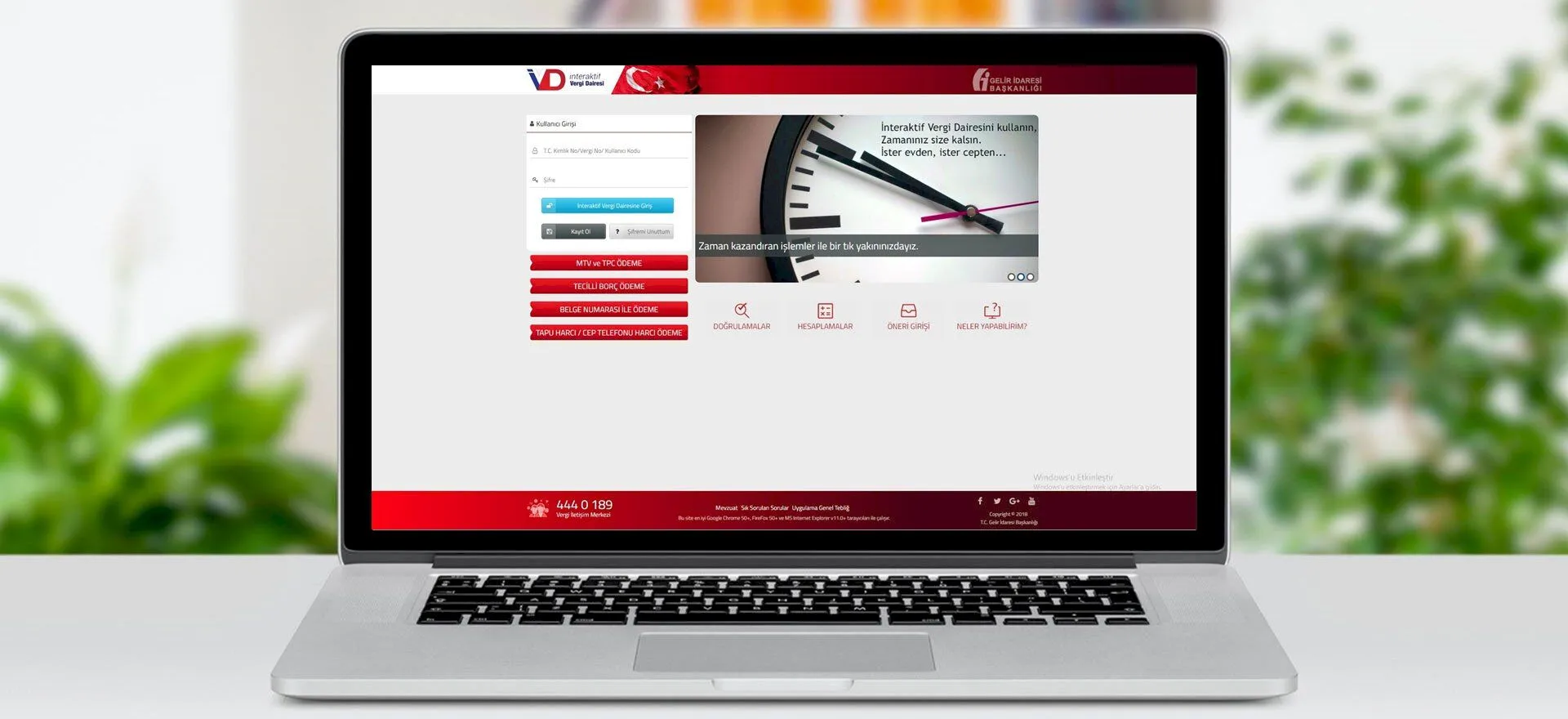

The e-declaration system allows taxpayers to easily prepare their declarations with its user-friendly interface. Taxpayers prepare their declarations by selecting and filling in the relevant declaration form. The system guides users by marking the fields to be filled in and the points to be considered.

Submitting and Approving Declaration

The prepared declarations are sent by signing with electronic signature or financial seal through the system. Electronic signature provides authentication of taxpayers and ensures the secure transmission of declarations. Declarations are received and approved by the tax administration. When the approval process is completed, taxpayers will receive a confirmation that their declaration has been accepted.

Advantages of E-Declaration

Environmentally Friendly

The e-declaration system takes an environmentally friendly approach by minimising the use of paper. Reduced paper consumption contributes to the reduction of tree cutting and the amount of waste paper. This is an important advantage in terms of environmental sustainability.

Transaction Tracking and Easy Audit

The electronic declaration system facilitates the follow-up and control of transactions. Electronic filing of returns allows the tax administration to audit taxpayer transactions more quickly and effectively. In addition, taxpayers can easily follow up their past declarations and transactions.

Ease of Updating and Correction

The e-declaration system enables updates and corrections to be made to declarations to be easily realised. Taxpayers can make the necessary updates through the system to correct errors or omissions that they notice after submitting the declaration. This ensures that the declaration processes are flexible and user-friendly.

Things to Consider in the Use of E-Declaration

Technical Requirements

The e-declaration system has certain technical requirements. Taxpayers are required to have appropriate hardware and software infrastructure for the system to function properly. Factors such as internet connection, an up-to-date web browser and electronic signature play an important role in the use of e-declaration.

Safety Precautions

The secure use of the e-declaration system is critical for the protection of taxpayers’ personal and financial information. The use of electronic signature is an important step to ensure data security. Taxpayers should use secure passwords and protect their personal information.

Timely Declaration

It is of great importance that taxpayers submit their declarations within the specified periods. The convenience provided by the e-declaration system encourages timely filing of declarations. Late filing of declarations may result in late penalties and interest. Therefore, taxpayers should pay attention to the declaration process.

The e-declaration system is a modern and user-friendly application that allows taxpayers to submit their declarations electronically to the tax administration. It offers many advantages such as speed, convenience, reduced error rate and cost savings. In Turkey, e-declaration, which has a legal basis with the Tax Procedure Law and the regulations of the Revenue Administration, enables tax transactions to be carried out more effectively and efficiently. It is important that taxpayers pay attention to technical requirements and security measures when using e-declaration. This system ensures the timely, accurate and secure filing of tax returns and contributes to environmental sustainability.

Previous Post

What is Inflation Accounting?

Next Post

What is E-signature?